All Categories

Featured

Table of Contents

The $40,000 increase over the initial bid is the tax sale overage. Declaring tax obligation sale excess suggests getting the excess money paid throughout a public auction.

That claimed, tax obligation sale overage insurance claims have shared qualities across many states. Normally, the county holds the cash for a given duration depending upon the state. Throughout this duration, previous proprietors and home mortgage owners can call the area and receive the excess. Counties usually don't track down past owners for this purpose.

If the duration expires prior to any kind of interested events assert the tax obligation sale overage, the county or state usually takes in the funds. Once the money goes to the federal government, the possibility of claiming it vanishes. For that reason, previous owners are on a strict timeline to case overages on their residential or commercial properties. While overages typically don't correspond to greater incomes, investors can benefit from them in numerous means.

Keep in mind, your state laws affect tax sale excess, so your state could not enable financiers to accumulate overage interest, such as Colorado. Nonetheless, in states like Texas and Georgia, you'll gain interest on your entire proposal. While this element does not indicate you can assert the excess, it does assist mitigate your expenditures when you bid high.

Tax Overages Business Opportunities Property Tax Overages

Remember, it might not be lawful in your state, meaning you're restricted to accumulating rate of interest on the overage. As stated over, an investor can find methods to benefit from tax sale overages. Tax Sale Overage List. Since passion revenue can use to your whole proposal and previous proprietors can assert overages, you can take advantage of your understanding and devices in these scenarios to maximize returns

A vital element to keep in mind with tax sale excess is that in most states, you only need to pay the region 20% of your complete bid in advance. Some states, such as Maryland, have legislations that exceed this policy, so once more, research your state laws. That claimed, many states comply with the 20% guideline.

Instead, you just need 20% of the bid. If the building doesn't retrieve at the end of the redemption duration, you'll need the staying 80% to get the tax act. Since you pay 20% of your bid, you can make interest on an overage without paying the full rate.

Trusted Property Tax Overages Program Tax Deed Overages

Again, if it's lawful in your state and county, you can function with them to aid them recover overage funds for an added cost. You can accumulate passion on an overage proposal and charge a fee to streamline the overage claim procedure for the previous owner.

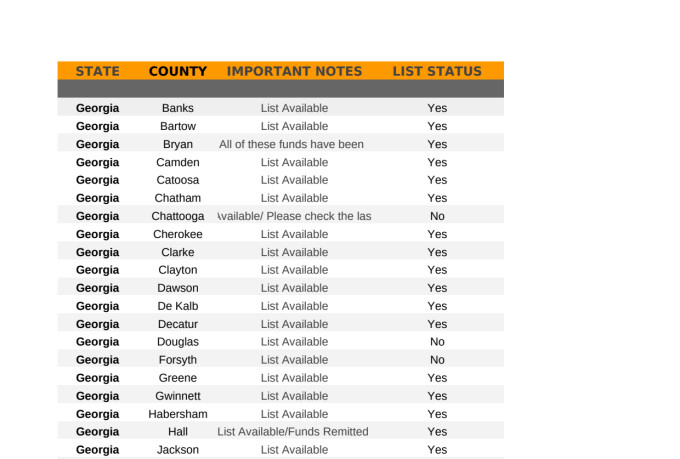

Overage collectors can filter by state, region, property type, minimum overage amount, and optimum overage quantity. When the data has been filteringed system the enthusiasts can make a decision if they desire to include the avoid traced information plan to their leads, and then spend for only the verified leads that were located.

In addition, just like any various other investment method, it offers one-of-a-kind pros and disadvantages.

High-Performance Tax Overage Recovery Strategies Guide Bob Diamond Tax Overages Blueprint

Tax sale overages can create the basis of your investment version because they provide an affordable method to make cash. You don't have to bid on buildings at public auction to invest in tax sale excess.

Doing so does not set you back thousands of countless bucks like acquiring several tax obligation liens would. Instead, your research study, which might include miss mapping, would cost a relatively small charge. Any kind of state with an overbid or exceptional proposal method for public auctions will certainly have tax obligation sale overage chances for financiers. Bear in mind, some state laws stop overage options for previous owners, and this concern is really the topic of a present High court case.

Cutting-Edge Foreclosure Overages Program Tax Overage Recovery Strategies

Your resources and technique will figure out the very best setting for tax obligation overage investing. That claimed, one strategy to take is gathering interest over premiums. Therefore, financiers can buy tax obligation sale overages in Florida, Georgia, and Texas to make the most of the costs proposal legislations in those states.

Any auction or foreclosure including excess funds is an investment opportunity. You can invest hours looking into the previous owner of a residential or commercial property with excess funds and call them only to discover that they aren't interested in pursuing the money.

You can begin a tax overage service with minimal expenses by tracking down details on recent buildings cost a premium bid. After that, you can call the past owner of the building and offer a cost for your services to help them recoup the excess. In this situation, the only cost involved is the study rather than costs 10s or thousands of thousands of dollars on tax obligation liens and actions.

These overages usually produce rate of interest and are readily available for previous proprietors to insurance claim - Tax Auction Overages. As a result, whether you buy tax obligation liens or are entirely curious about cases, tax sale overages are financial investment opportunities that call for hustle and solid research study to make a profit.

Reliable Tax Sale Overage Recovery Education Tax Auction Overages

An event of passion in the home that was cost tax obligation sale may assign (transfer or sell) his or her right to claim excess profits to another person just with a dated, created paper that clearly states that the right to claim excess proceeds is being assigned, and only after each celebration to the proposed assignment has revealed to each various other party all truths associating to the worth of the right that is being assigned.

Tax sale overages, the surplus funds that result when a property is sold at a tax obligation sale for even more than the owed back tax obligations, costs, and costs of sale, represent an alluring opportunity for the initial residential property proprietors or their beneficiaries to recuperate some worth from their lost possession. Nevertheless, the process of asserting these overages can be intricate, mired in lawful procedures, and vary dramatically from one territory to one more.

When a property is marketed at a tax obligation sale, the key goal is to recuperate the overdue residential or commercial property tax obligations. Anything above the owed quantity, consisting of fines and the cost of the sale, ends up being an excess - Overages List by County. This excess is essentially money that should truly be returned to the previous home proprietor, assuming no other liens or insurance claims on the home take priority

Latest Posts

Overage Refund

Tax Foreclosures Sale

Investing In Real Estate Tax Liens